Clearing the path to affordable stand-alone bike insurance

Remember when you first learned how to ride a bike without training wheels? Remember racing over to your friend’s house or riding around the park after school? Many of us have fond memories riding our bikes as kids which is why plenty of us still continue to ride as adults.

But do you also remember your first big spill? Maybe you ended up with scrapes, bruises, or even ripped knees on your jeans. Maybe you even got in trouble with your parents for those ripped pants. The joy of riding has stuck with you over the years, and unfortunately, so has the statistical likelihood of an accident occurring.

We’ve taken the time to put together the *drum roll please* Ultimate Guide to Bicycle Insurance to cover what it is, why you need it, and how to get an affordable policy.

What’s Inside This Article

- Bicycle injury statistics

- Bicycle theft statistics

- What is bicycle insurance? How is it different from other types of insurance?

- Why do cyclists need bicycle insurance?

- How much does bicycle insurance cost?

- What does bicycle insurance cover?

- How do I get a bicycle insurance quote?

- What happens if I need to make a claim?

- Get a quote

- More cycling resources

Bicycle injury statistics

Each year, the National Highway Traffic Safety Administration (NHTSA) releases reports about all kinds of accidents, injuries, and fatalities. Most of these reports pertain to vehicles, but they also release data about cyclists. In 2015, they released a report outlining cyclist injury and fatality numbers in the United States, and here’s a quick run-down of what they found.

Between 2006 and 2015, the percentage of cyclist fatalities rose steadily from 1.8% to 2.3% of all traffic-related fatalities. This doesn’t seem like a lot at first glance since it’s less than 1% over nearly a decade. However, if we look at the numbers themselves instead of the percentages, it’s a different story. The lowest number of cyclist fatalities in traffic-related accidents was in 2010 with 623 deaths. The highest number reported was 818 in 2015. That’s close to 200 additional fatalities.

According to the same data set, the majority of cyclist fatalities occurred during rush hour on weekdays (3 PM – 6PM) and evenings (6 PM – 9 PM) on the weekends. This is particularly alarming because according to Department of Transportation data cited by Outside, more than 850,000 people use their bicycle to commute to and from work each day in the United States.

Cyclist fatalities are only a part of this incredibly unfortunate puzzle. In 2015 alone, the NHTSA reported 45,000 cyclist traffic-related injuries. The Center for Disease Control and Prevention reported closer to a total of 460,000 bicycle-related injuries (which may or may not include traffic collisions).

So what does this mean for cyclists? In short, this means that injuries and even fatalities are a reality for the cycling community and it’s costing billions of dollars each year in medical costs and productivity loss.

Bicycle theft statistics

According to 529 Garage, about 1.7 million bicycles are stolen every single year in the United States — which, as we know, is about one every 30 seconds. Bike theft has plagued the cycling community for decades and in 2020 alone, Bike Index reported a 68% jump in thefts between April and September.

The strange part is that these numbers could be, and likely are, even higher in reality. Because typically you’ll need a serial number to either register your bicycle, or report it as stolen, some cyclists don’t know their number until it’s too late. Additionally, many cyclists feel once their ride is stolen, it’s never going to be recovered so “why bother?”.

Bicycles have pretty much always been a target for theft and many cyclists are aware of this. Despite indestructible locks, chains, and creative security measures, thieves are keeping up. While doing things like registering your bicycle online and purchasing a stand-alone bicycle insurance policy can help recover your stolen bike or its value, thieves are probably going to be around for a long time anyway.

Bike thieves are constantly on the prowl to break open locks, steal bicycles, and flip them online for a profit. They’re going to target bicycles that:

- Aren’t locked up properly

- Have locks that are easy to pick or cut

- Are unattended

- Left outside at night

- Cost a lot

- Cost a little

- And dozens more reasons

To summarize, bicycle theft is a reality and doesn’t seem to be budging any time soon. However, there are things cyclists can do to increase their chances of preventing theft, recovering a stolen bicycle, or being reimbursed for the value of their bicycle if it’s not recovered.

Resources for preventing theft:

Tips for recovering a stolen bicycle:

Getting reimbursed for a stolen bike:

What is bicycle insurance? How is it different from other types of insurance?

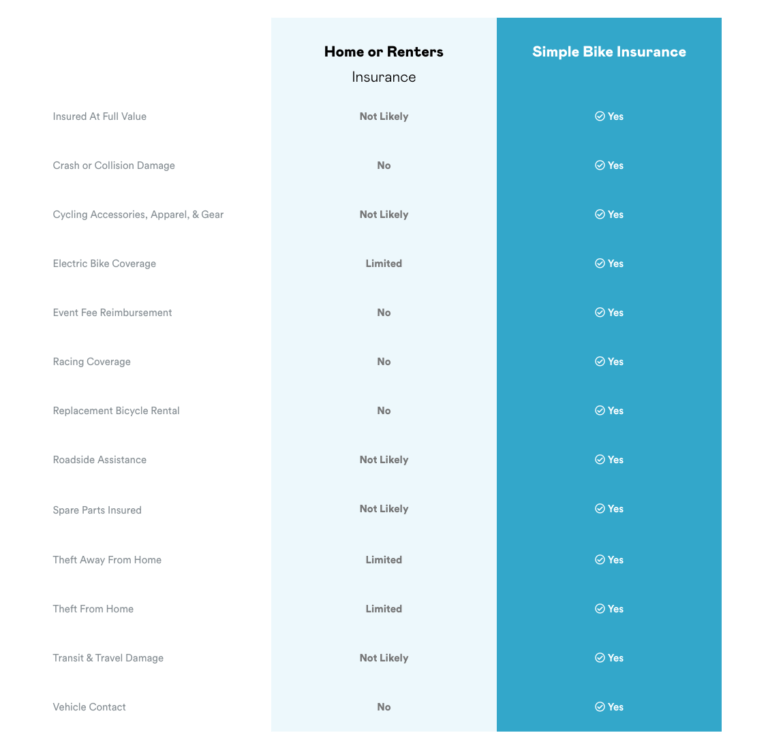

Bicycle insurance is a stand-alone insurance policy for people who own and ride bikes. This type of insurance is specifically designed with cyclists in mind and aims to not only protect a cyclist’s personal property, but also the cyclist. In this way, it’s different than things like renter’s insurance, homeowner’s insurance, or even umbrella insurance — these policies typically won’t cover things that cyclists are actually at risk for like:

- Having a bicycle stolen from work, while running errands, or anywhere else that’s not considered “the home”

- Crashes and collisions with vehicles on the road

- Flat tires, broken or slipped chains, or other bicycle issues that might leave a cyclist stranded

- Stolen electric bicycle batteries

- Medical costs as a result of injury

- And so much more

Let’s break bicycle insurance down by comparing it to other common types of insurance cyclists use for their bikes. Below you’ll see what’s covered, what isn’t, and what’s partially covered.

In addition to differences in coverage, other types of insurance are likely to raise premiums if the policy-holder makes a claim. An insurance premium is what you pay each month to have the policy. Your premium doesn’t include things like deductibles and out-of-pocket costs or copays (it’s just the monthly fee).

If something bad happens that you think your insurance is supposed to cover, you’ll make a claim. This usually involves filling out some paperwork, providing a statement, and sending over supporting documentation. Your insurance company then processes your claim and:

- Decides whether your claim is legitimate (i.e. they’ll accept or deny your claim)

- Decides how much they’ll dispense in benefits (i.e. how much money they’ll give you)

- Possibly “ding” your account

Let’s walk (or ride?) through an example. You’re a commuter cyclist and you decide to skip bicycle insurance and just cover the cost of your bicycle through a homeowner’s insurance policy you’ve had for six months. Unfortunately, the one day you take the train to work, your bike is stolen from your home. You decide to report the bike as stolen and make a claim with your insurance company. They’ll likely dispense benefits for some of your bicycle’s value and they’re probably going to raise your monthly premium rate next year when it’s time to renew.

Now, let’s say instead of your bicycle being stolen from your home, it’s stolen from your work. There’s a decent chance your homeowner’s insurance company isn’t going to approve your claim at all, and if they do, you’ll only receive partial benefits (i.a. you won’t get the full value of your bicycle back). Kind of lame, right?

Depending on the insurance company you choose to partner with, your stand-alone bicycle insurance policy premiums won’t go up if you file a claim. If your bicycle is stolen from work, or from your apartment, you’ll still get the full value of your bicycle back. Plus, if you need a temporary bicycle rental to get to-and-from work while you’re waiting on your benefits, they’ll probably cover that too. Huge difference.

Why do cyclists need bicycle insurance?

The team here at Simple Bike Insurance is a bunch of cycling enthusiasts. We’re out racing and hitting the trails, and talking with cyclists just like you. We noticed that tons of cyclists aren’t aware that they aren’t covered for as much as they think through their other policies. This is actually why we decided to start Simple Bike Insurance — to help fill in the gaps and make sure cyclists are getting what they need. This includes things like:

- Medical cost coverage

- Options to add on liability protection or worldwide transit protection

- Racing fee reimbursements

- Coverage for bicycle spare parts, cycling apparel, and other riding accessories

- Loss, theft, and damage coverage

Basically, if something goes wrong, your bicycle insurance company should be your spokespeople — not your enemies. Cyclists are choosing bicycle insurance for protection and peace of mind they can’t get anywhere else, that’s geared towards their cycling styles, preferences, and needs.

How much does bicycle insurance cost?

There are a few answers to this question and it’s because it’ll depend on what you choose. If you opt to purchase a policy with another bicycle insurance provider, we aren’t sure what they’re going to charge. If you choose to purchase a policy with Simple Bike Insurance, we can tell you that our basic policies start at just $100 a year (or less than $8.50 a month).

We keep our bicycle insurance rates and coverage costs as affordable as possible, and we put you in control. This means you get to choose:

- How much you want to insure your bicycle for

- Whether you want a lower deductible or a lower premium

- What type of cyclist you are

- Extra policy add-ons to match who you are as a cyclist

What you enter in our instant quote builder is what your monthly cost will be — it’s up to you. In addition, if you belong to select cycling memberships, you’ll get 10% off your policy.

What does bicycle insurance cover?

With Simple Bike Insurance, a basic insurance policy gets cyclists quite a bit for as little as $100 a year. If you don’t opt into any of the premium add-ons, you’ll get:

- Bike repair or replacement at full-value in case of damage, theft, crash, vandalism, or collision with other cyclists

- Racing protection

- Spare parts, accessories, and apparel up to $500 per claim and $1,000 per policy term

- Transit protection to and from locations within the United States and Canada

If you’re a competitive cyclist and race in events, we’ll throw in extra coverage for no additional costs. Our racing coverage includes:

- Rental reimbursements up to $250 per claim for damaged or stolen bikes away from home and participating in an organized riding event

- Competitive racing fee reimbursement

- Nonrefundable riding event fees reimbursement up to $500 per claim and $1,000 per policy term if your bike is involved in a covered incident and you can no longer compete/participate

We also offer electric bicycle coverage for e-bike motors that are 750 watts or less. As long as you don’t use an auxiliary power source, you’ll get all the same stuff we offer for traditional bicycles as long as you have a:

- Pedal assist e-bike with top assisted speed of 20 mph

- Throttle assist e-bike with top assisted speed of 20 mph

- Pedal assist e-bike with top assisted speed of 28 mph

To take even more control over your coverage, you can add on policy extras to customize your plan. Each one is affordable, and you get to pick and choose the ones you want.

- Bicycle liability up to $25,000

- Medical payments up to $1,000

- Vehicle contact protection up to $10,000

- Worldwide physical damage

- Roadside assistance

To sum up, you get to choose how much coverage you want. Because you get to build your own bicycle insurance policy, you’re less likely to be underinsured or overpaying for things you don’t need.

How do I get a bicycle insurance quote?

Getting a bicycle insurance quote online is easy and takes about five minutes (usually even less than that). Before you get started, you’ll need to run through this quick checklist and make sure you have everything you need.

- Find your bicycle’s serial number

- Know your bicycle’s make, model, and year

- Know whether you bought your bike new or used

If you don’t know where to find your bike’s serial number, check out our serial number guide here. If you aren’t sure about your bike’s make, model, and year, we suggest doing a search in your email to find the manufacturer’s invoice. If you bought it used, you might want to check your Venmo, PayPal, or other money transferring apps to find out when you bought it.

When you’re ready, click here to get an instant bicycle insurance quote. Just fill out the form with information about you, how you ride, and your bicycle. We’ll crunch the numbers and let you choose how you want your policy to work. Then, you can purchase your policy right then and there — or you can go back to keep customizing your policy.

If you’d prefer to get a quote from one of our team members, just give us a call or use our contact form. We can help you get started and quote you a policy.

What happens if I need to make a claim?

In the event something happens and it’s time to make a claim, we’ve got a guide for that, too. Basically, you’ll need to gather some information and follow the steps below. It’s easy and we’re always here to answer your questions along the way.

- Try your best to prevent further injury, damage, or loss. First and foremost, get yourself out of harm’s way

- Contact your local authorities to report any illegal activity. Ask for a copy of the report

- Get photos of the damage or anything related to the incident

- Find receipts for anything you’re making a claim for. This could be for your bicycle, helmet, locks, riding apparel, etc.

- If you’re taking your bicycle to the shop for a repair, get a copy of the repair assessment

- Write up a statement telling us what happened

- Send everything our way. This includes the photos, police reports, repair assessments, and receipts listed above

That’s it! We’ll take care of the rest and get in touch with you if we need to. When your claim has been processed, we’ll dispense benefits and make sure you’re getting clipped back in ASAP.

Simple Bike Insurance offers comprehensive, affordable stand-alone bicycle insurance policies. Get started with an instant quote and policies starting at just $100 a year. It’s easy, it’s fast, it’s simple.